What Happens If My Belongings Get Damaged During A Move?

What Happens If My Belongings Get Damaged During A Move?

Are your belongings protected during a move?

Professional packers using the best packing supplies, sturdy moving boxes, and the best carrying and loading techniques is a great way to protect your household goods during a local or long-distance move. But even when the packing and moving is done right, damage can occur.

It’s the nature of moving; items getting handled, wrapped, packed, carried, loaded, and transported locally or long-distance. And then it all happens in reverse; unloaded, carried, unpacked, unwrapped, and placed. Sometimes damage happens despite professional care.

So, what happens if your furniture or other belongings get damaged during a move? Are your items covered by homeowners insurance during a move? Is there such a thing as moving insurance? These are all common questions people have when moving, and it’s important to know the answer before you move.

ARE MY BELONGINGS COVERED IF I MOVE MYSELF?

If you choose to do your packing and moving yourself, it’s important to know that standard homeowners insurance does not provide full coverage. For example, if your dishes aren’t wrapped properly and it chips during the move, home insurance wouldn’t cover the loss. If you drop your kitchen table and break one of the legs, that wouldn’t be covered. “Homeowners insurance only covers damage caused by a covered peril, which is an unexpected event that causes damage or loss to your home or belongings, such as fire, lightning, wind, theft, and vandalism,” according to Mike Muir of Muir Insurance Group. “If you are moving high-value items, you might want to consider adding a scheduled personal property endorsement,” said Muir.

If you choose to move yourself and rent a moving van, moving trailer, or moving truck, it’s important to understand the type of insurance or coverage they offer. Most moving truck rental companies offer coverage to protect their vehicles from accident damage, such as a collision with another vehicle or a cracked windshield caused by a flying rock. Most also offer some form of optional protection for your belongings, but only for loss or damage that results from things like a collision or fire. This coverage does not cover damage caused by improper packing or loading, shifting of items during transit, or theft.

In short, if you do the packing and moving yourself, you will most likely not be covered for any damage that occurs because of standard moving activities.

ARE MY BELONGINGS COVERED IF I HIRE PROFESSIONAL MOVERS?

If you hire a reputable, professional mover, you will receive some level of coverage for your belongings. The coverage will differ depending on what type of move it is. When you move within the same state it’s referred to as an intrastate move. These moves are regulated by the individual state and therefor the coverage required will be different by state. Check with your state moving association if you are moving to a new location within the same state. If you are moving from one state to another it is called an interstate move, and those moves are federally regulated. According to the Federal Motor Carrier Safety Administration (FMCSA), under Federal law, interstate movers must offer two different liability options referred to as valuation coverage: Full Value Protection and Released Value.

WHAT IS MOVING VALUATION VS. MOVING INSURANCE?

Moving valuation and moving insurance are two different types of coverage for your belongings when moving homes. They provide different levels of coverage and serve distinct purposes:

Moving Valuation:

- Moving valuation is not insurance but rather a protection plan that defines the maximum coverage a moving company provides for the loss or damage of belongings.

- Under moving valuation coverage, the moving company is responsible for the value of your items based on their weight, not their actual cash or replacement value.

- For interstate moves, moving between 2 different states, the federal government regulates the valuation coverage, and your moving company must offer Full Value Protection and Released Value.

Moving Insurance:

- Moving insurance, on the other hand, is a separate insurance policy that you can purchase to provide more comprehensive coverage for your belongings during a move.

- It is typically offered by third-party insurance providers, not your moving company, and can be tailored to your specific needs and the value of your possessions.

- Moving insurance policies can offer different types of coverage, such as full replacement value or actual cash value coverage. Full replacement value coverage will reimburse you for the cost of replacing the item with a similar new item, while actual cash value takes depreciation into account.

- Moving insurance allows you to declare the value of your items and pay premiums based on that declared value.

- If your possessions are lost, damaged, or stolen during the move, the insurance policy will provide compensation up to the declared value, subject to the policy’s terms and deductibles.

WHAT'S THE DIFFERENCE BETWEEN FULL VALUE PROTECTION AND RELEASED VALUE PROTECTION?

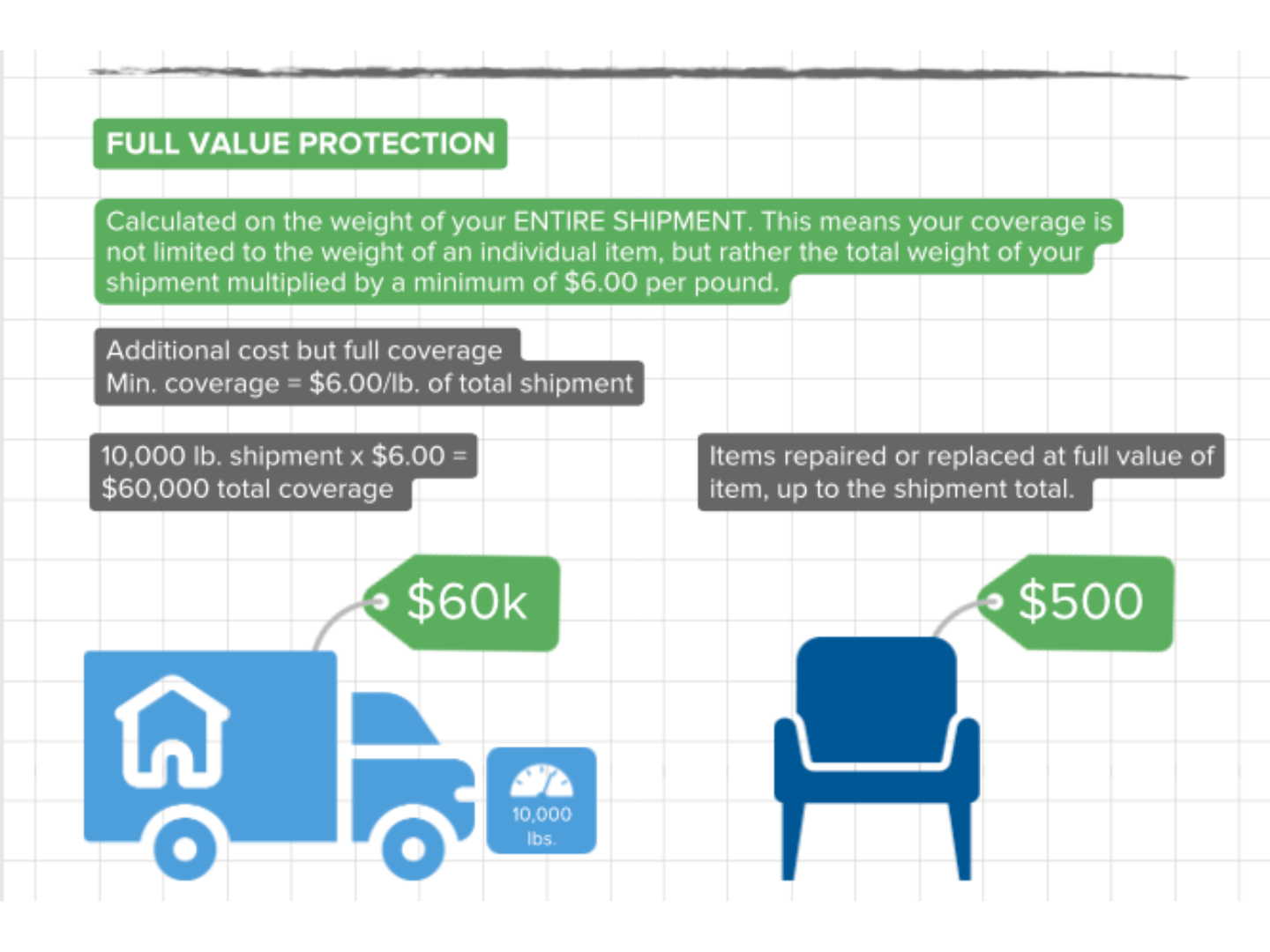

Full Value Protection provides for the replacement value of belongings that are lost or damaged during your move. Full Value Protection is the more comprehensive option, and therefore costs a bit more, but is considered the best option for protecting your belongings. Unless you specifically request to downgrade your coverage to Released Value, your mover will most likely automatically include Full Value Protection in your moving estimate. Ace Relocation strongly recommends Full Value Protection and includes it in your moving estimate unless you specifically request to downgrade to Released Value Protection.

With Full Value Protection, if any of your items are lost, destroyed, or damaged while moving, your mover will either:

- Repair the item.

- Replace with a similar item.

- Pay for the cost of the repair or the current market replacement value.

Full Value Protection covers your belongings at minimum of $6.00 per pound of the total shipment weight. For example, if the total weight of all your belongings being transported on the moving truck is 10,000 pounds, then the minimum coverage of your shipment is $60,000. So, in the unlikely event of the loss of all your belongings, under Full Value Protection of a 10,000 pound shipment, you would be covered for $60,000. If you have high-value belongings, usually items valued at over $3,000, you should itemize these and declare them on a high value inventory form. When you do that your mover will include these declared high-value items above and beyond the standard $6.00 per pound.

Released Value Protection is offered by movers at no additional charge because the protection is minimal. Released Value Protection is based on the weight of each individual item, not the total weight of your shipment. Where Full Value Protection covers items at a minimum of $6.00 per pound of the total shipment, Released Value Protection covers items at only $0.60 per pound per item, meaning it pays out only on the weight of the individual item that is damaged. So your same shipment of 10,000 pounds has a maximum coverage of $6,000 under Released Value Protection, as opposed to $60,000 under Full Value Protection. But remember, the coverage is based on each item’s weight. So if you have a chair that weighs 50 pounds, the maximum coverage for that chair is $30, no matter what the replacement value is.

If you choose to go with Released Value Protection, you are required to sign a specific statement on the bill of lading or contract agreeing to it. Just remember that you will only be compensated according to the weight of the item, not its actual value. If you do not select Released Value Protection, your shipment will automatically be transported at the Full Value Protection.

MOVING COVERAGE - WHAT YOU NEED TO KNOW

In summary, if your belongings get damaged during a move using licensed, professional movers, your items will be protected by some form of moving valuation coverage; from Released Value Protection to Full Value Protection depending on your mover, your type of move (interstate vs. intrastate), and the coverage choices you make. Always look for reputable, licensed movers and ask about their valuation coverage options. If you have high-value items, usually anything over $3,000, be sure to discuss those items with your mover. And if you decide to move yourself, be aware that your homeowners insurance will most likely not cover damage caused as part of the move and you may want to purchase a separate moving insurance policy.